Are you claiming all your small business tax concessions?

As you are aware, depreciating assets are usually depreciated over the life of the assets according to depreciation rules that apply uniformly to all entities regardless of their size.

However, from the 2013 income tax year, if you are a small business entity (i.e., your aggregated1 turnover is less than $2 million), you can qualify for simplified depreciation arrangements for depreciating assets (and cars).

Likewise, if an asset is sold for more than you acquired it, the gain will usually be subject to capital gains tax (CGT). However, if you are a small business entity or you satisfy a net asset value test (i.e., the aggregated value of all your net assets is equal to or less than $6 million), the small business CGT concessions may apply to either eliminate, reduce or defer this capital gain.

Snapshot of the simpler small business depreciation rules

From the 2013 income tax year, the small business instant asset write-off threshold has increased from $1,000 to $6,500.

This means that a small business with an aggregated turnover of less than $2 million that bought an asset for $3,000 and started using it in the business before 30 June 2013 can claim the full $3,000 as a tax deduction in the 2013 income tax year.

Also, for motor vehicles costing $6,500 or more2, such a small business can claim an immediate deduction of $5,000 plus 15% of the remaining amount (i.e., cost price minus $5,000).

This means that assuming a motor vehicle costs $14,000, the taxpayer can claim a total deduction of $6,350 [$5,000 + 15% x ($14,000-$5,000)] in the 2013 income tax year.

The depreciation pooling arrangements (for assets with a cost of more than $6,500) have also been simplified by consolidating the long life small business pool and the general small business pool into a single pool to be written off at a rate of 15% in the first year and 30% in subsequent years.

This means that assuming you have an opening balance of $18,000 for your single small business pool and acquired another asset in 2013 for $7,500, the amount of depreciation you can claim in 2013 would be equal to $6,525 [$1,125 ($7,500 x 15%) and $5,400 ($18,000 x 30%)].

Snapshot of the small business CGT concessions

The small business CGT concessions are available to small businesses on both the sale of assets of a business (whether you sell a single asset or all the assets of the business) or on the sale of the entity through which the business is carried on.

To qualify for these concessions, you have to satisfy certain basic conditions dealing with:

- the size of the entity (i.e., the $2 million turnover or $6 million net asset value test); and

- the type of asset for which the concession is claimed (i.e., the asset must be an active asset – that is an asset used in the business or used in the business of an affiliate or entity connected with the entity).

Additional basic conditions that will not be discussed further in this article (e.g., CGT concession stakeholder and significant individual test) also apply for shares held in a company or interests in a trust.

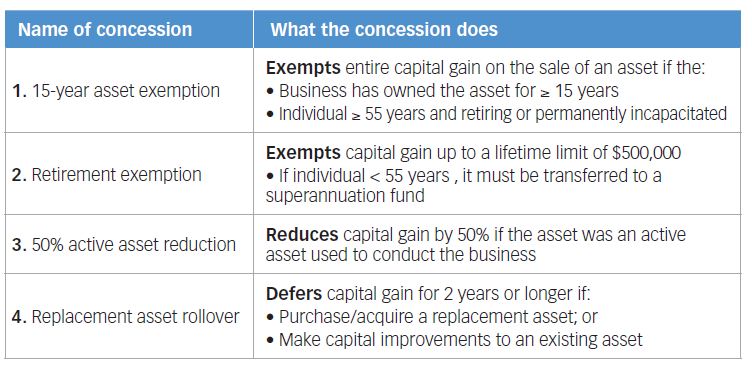

The table below provides an overview of the four small business CGT concessions (and briefly notes specific additional conditions relating to each individual concession).

A further advantage of these concessions is that they can be claimed in addition to (and not as an alternative to) the other available CGT concessions (e.g., 50% CGT discount for non-companies or other rollovers on business restructures).

Heightened compliance activity

The ATO is concerned that entities who are eligible to claim the concessions, do not claim the correct amount and that even entities that are not eligible3 to claim these concessions, still try to claim the concessions regardless of this fact.

Therefore, the ATO has been on the warpath against businesses claiming the small business CGT concessions and there has been a marked spike in litigation4 on how to calculate which assets and liabilities to include when determining whether the $6 million net asset value test has been breached.

Conclusion

Claiming the small business CGT concessions can be a very complicated affair, especially in light of the heightened ATO compliance activity in this area.

However, if you are thinking of selling your business, please speak to your Nexia adviser so that we can assist you in determining whether you could qualify for the small business CGT concessions when you eventually sell your business.

We can also perform a financial health check on your business and assist with any potential succession plans / business exit strategies that you may want to talk about.

Roelof Van Der Merwe, Nexia Australia National Tax Director

1 Aggregated turnover/assets refer to the sum of the turnover/assets of your affiliates and businesses connected with you.

2 Motor vehicles costing less than $6,500 can be depreciated immediately under the instant asset write-off rules.

3 ATO, Compliance in Focus 2013-14, Page 12

4 Bell v FCT [2013] FCAFC 32; White v FCT [2012] FCA 109; FCT v Byrne Hotels Qld Pty Ltd [2011] FCAFC 127;

2 Motor vehicles costing less than $6,500 can be depreciated immediately under the instant asset write-off rules.

3 ATO, Compliance in Focus 2013-14, Page 12

4 Bell v FCT [2013] FCAFC 32; White v FCT [2012] FCA 109; FCT v Byrne Hotels Qld Pty Ltd [2011] FCAFC 127;