Understanding the common control exemption

AASB 3 Business Combinations is applied to determine the accounting treatment, presentation and disclosure of business combinations in the accounting records and financial statements of the acquirer.

AASB 3 defines a business combination as a transaction or other event in which an acquirer obtains control of one or more businesses. However, very importantly, AASB 3 does not apply to a combination of entities or businesses under common control. The inappropriate application of AASB 3 to business combinations under common control could lead to the incorrect restatement of the assets of the acquiree at fair value and the recognition of goodwill or a gain on acquisition in the financial statements of the acquirer.

What is a business combination under common control?

A business combination involving entities or businesses under common control is a business combination in which all of the combining entities or businesses are ultimately controlled by the same party or parties both before and after the business combination, and that control is not transitory. This will include transactions such as the transfer of subsidiaries or businesses between entities within a group.

The common control exemption is not restricted to transactions between entities within a group.

An entity can be controlled by an individual or a group of individuals acting together under a contractual arrangement and they may not be subject to the financial reporting requirements of Australian Accounting Standards.

It is not necessary for combining entities to be included as part of the same consolidated financial statements for a business combination to be regarded as one involving entities under common control.

Therefore, a business combination is outside the scope of AASB 3 when the same group of individuals has, as a result of contractual arrangements, ultimate collective power to govern the financial and operating policies of each of the combining entities so as to obtain benefits from their activities, and that ultimate collective power is not transitory.

It is possible for a contractual arrangement to be in a non-written form. Clearly, if it is not written, great care needs to be taken with all of the facts and circumstances to determine whether it is appropriate to apply the common control exemption.

One particular situation where this is likely to be the case is where the individuals concerned are members of the same family, since there is unlikely to be any written contractual agreement. In such situations, whether common control exists between family members very much depends on the specific facts and circumstances.

A starting point can be the definition of ‘close members of the family of a person’ in AASB 124 Related Party Disclosures.

The AASB 124 paragraph 9 defines ‘close members of the family of a person as those family members who may be expected to influence, or be influenced by, that person in their dealings with the entity and include:

- that person’s children and spouse or domestic partner;

- children of that person’s spouse or domestic partner; and

- dependants of that person or that person’s spouse or domestic partner’.

If the individuals concerned are ‘close members of the family’ as defined in AASB 124, then it is possible that they will act collectively, and the common control exemption should be applied.

I further believe that there should be a presumption that common control does not exist between non-close family members and a high level of evidence that they act collectively, rather than independently, would need to exist to overcome this presumption.

In all situations involving family members, whenever there is evidence that the family members (irrespective of the family relationship) have acted independently then the common control exemption does not apply.

Pooling of interest method or acquisition method

AASB 3 scopes out common control business combinations, often referred to as the ‘common control exemption’. AASB 3 is not prescriptive as to what method must be followed in common control business combinations. AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors requires that in the absence of specific guidance in International Financial Reporting Standards (IFRS), management shall use its judgement in developing and applying an accounting policy that is relevant and reliable. In making that judgement, in the absence of an IFRS dealing with similar or related issues or guidance within the Conceptual Framework for the Preparation and Presentation of Financial Statements, management may also consider the most recent pronouncements of other standard setting bodies that use a similar conceptual framework to develop accounting standards, to the extent that these do not conflict with the Framework or any other IFRS or interpretation. Several bodies have issued guidance and some allow or require the pooling of interests method (or predecessor or merger accounting) for business combinations involving entities under common control.

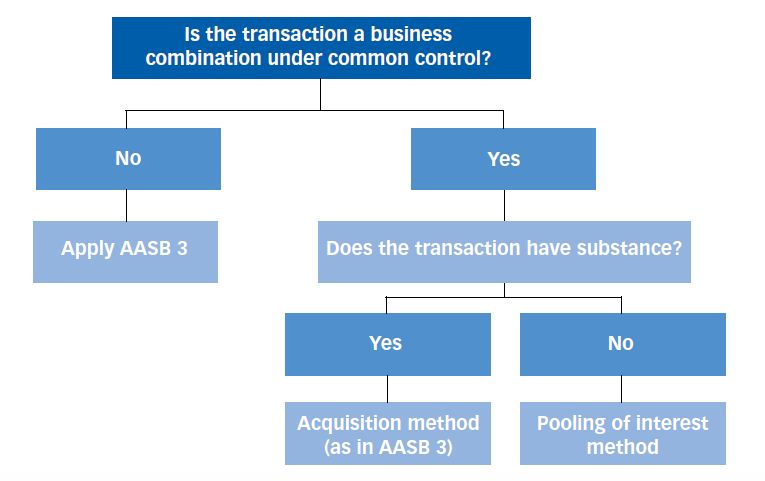

In my view, entities in accounting for business combinations involving entities or businesses under common control should apply either:

- the pooling of interest method; or

- the acquisition method (as in AASB 3).

‘Fresh start accounting’ whereby all combining business combinations are restated to fair value, is not an appropriate method of accounting for combinations between entities under common control.

Whichever policy is adopted, it should be applied consistently. In my view, where the acquisition method of accounting method is selected, the transaction must have substance from the perspective of the reporting entity, because the acquisition method results in:

- a reassessment of the value of net assets of one or more of the entities involved; and/or

- the recognition of goodwill or a gain on acquisition.

Therefore, if there is no substance to the transaction, the pooling of interest method is the only method that may be applied.

When evaluating whether the transaction has substance, the following factors should all be taken into account:

- the purpose of the transaction;

- the involvement of outside parties in the transaction, such as non- controlling interests or other third parties; '

- whether or not the transaction is conducted at fair value;

- the existing activities of the entities involved in the transaction;

- whether or not it is bringing entities together into a ‘reporting entity’ that did not exist before; and

- where a new entity is established, whether it is undertaken in connection with an IPO or spin-off or other change in control and significant change in ownership.

The diagram below outlines the key decisions in relation to accounting for business combinations under common control.

Conclusion

IFRS contain limited circumstances when net assets may be restated to fair value and restricts the recognition of internally generated goodwill, and a common control transaction should not be used to circumvent these limitations.

Aletta Boshoff, Nexia Australia and New Zealand Technical Director