Exciting prospects for emerging gold producer

A long-term Nexia client, Hawthorn began trading in its current form in 2008, having a name change from Great Gold Mines NL and in the same year subsequently merged with ASXlisted Ellendale Resources NL (ASX:ELL), but its exploration history dates back even further.

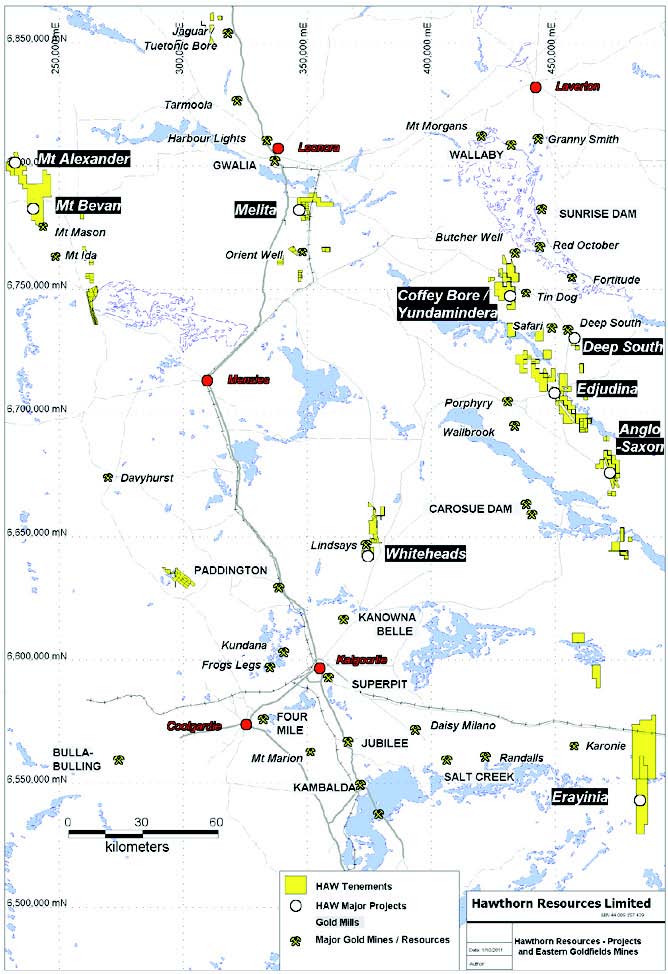

Hawthorn has undertaken drilling and development programs on its gold exploration projects - Anglo Saxon, Edjudina, Deep South, Whiteheads and Yundamindera in WA.

Hawthorn chairman and non-executive director, Mark Kerr is confident the company will achieve its first gold production within the next 12 months.

“Hawthorn has title to more than 100 exploration, mining and prospecting licences over our five project areas,” Mr Kerr said.

“Our tenements are surrounded by currently operating gold mines and more than 20 million ounces of gold has been extracted or delineated in this region to date.

“In 2012, Hawthorn was pleased to announce an updated Indicated and Inferred Gold Resource at the Anglo Saxon prospect of 23,020 ounces of gold. This was focused only on the shallow, oxide portion of the much larger historically calculated Inferred Resource of 135,000 ounces of gold in the Anglo Saxon area.”

Hawthorn’s Anglo Saxon project, which it has in joint venture with Gel Resources (30 per cent), is centred on the historic Anglo Saxon mine and is situated 140 kilometres north-east of Kalgoorlie, in WA. The project area is also 35 kilometres to the east of the Carosue Dam mill

of Saracen Mineral Holdings.

Mr Kerr said Hawthorn has been enhanced by a landmark partnership last year with a group of Chinese investors through Feng Hua Mining Investment Holding (HK) Limited.

“The Share Subscription Agreement saw new equity capital of approximately $15 million invested into Hawthorn,” Mr Kerr said.

“Feng Hua is comprised of four investors – Guangdong Feng Hua Advanced Technology (Holding) Co. Ltd. (GFAT); Guangdong Rising Assets Management Co. Ltd. (GRAM); Guangdong Corporation of Geology and Mineral (GGM), and Lite Smooth Investment Limited (LSI).

“Three of these are state-owned enterprises with extensive mining, manufacturing and banking expertise.

“The partnership is an exciting prospect for Hawthorn and its shareholders. We believe that the partnership will provide the impetus for aggressive exploration programs transitioning to development.”

He said Hawthorn has already completed further drilling programs to test the extent of its expanded ore model in the Anglo Saxon project and an updated resource is expected to be announced later this year.

“Recent drilling was successful with 27 of the 31 holes drilled returning encouraging gold assays,” Mr Kerr said.

“Hawthorn’s aim is to increase the mineable reserve base in the Anglo Saxon project area and potentially move into production in early 2014 with further drilling, feasibility and premining studies currently underway.”

Hawthorn’s Deep South project has tenements in joint venture with Alacer Gold Corporation (20 per cent) 170 kilometres north-east of Kalgoorlie. Hawthorn has identified immediately along the strike of its tenements a gold mineralised horizon analogous to the adjacent Deep South mine of Saracen Mineral Holdings.

A further five kilometres north-east, the Yundamindera project, again in joint venture with Alacer Gold Corporation (20 per cent), has identified broad zones of gold mineralisation.

The Whiteheads project, 100 per cent owned by Hawthorn, focuses on an area of surrounding gold production and where it has identified significant gold in soil anomalies that will be assessed in late 2013.

Drilling and sampling in the Edjudina-Triumph project area, also controlled by Hawthorn, has revealed well-defined, high-grade gold lodes.

Hawthorn has also previously discovered a significant iron ore project at Mt Bevan, 100 kilometres from Leonora in the central Yilgarn region of WA, for which it has 40 per cent ownership and has farmed out a 60 per cent joint venture partnership to Legacy Iron Ore.

“We have a highly prospective iron ore project that has the potential for marketing and export,” Mr Kerr said.

“Hawthorn continues to evolve and during this time, we have upgraded our website, www.hawthornresources.com, to keep shareholders fully informed of our developments.

“The company has established a strong and experienced management team, augmented by our cornerstone Chinese investor Feng Hua and the expansion of our board of directors. We have a strong balance sheet with cash reserves and carry no debt.”

Hawthorn is currently trading at a discount to its cash backing.