Potential changes to UK pensions transfers to Australia

From 6 April 2015, members of unfunded public sector pension schemes may no longer be able to transfer the money to an Australian Qualifying Recognised Overseas Pension Scheme (QROPS).

Other UK pensions may still be transferrable to an Australian super fund beyond April, however the new rules could require a scheme member to take financial advice from a UK qualified advisor (if the transfer value is more than £30,000).

What does this mean for me?

Those affected may no longer have access to the potential benefits of transferring, including:

- Potentially being able to access capital sooner;

- Saving up to 45% tax on your ongoing pension income;

- Flexibility to access your pension as a full lump sum (which is tax free after age 60, rather than taxable as income in the UK);

- Control over your investments; or

- The ability to pass 100% of your remaining pension to your beneficiaries in the event of death.

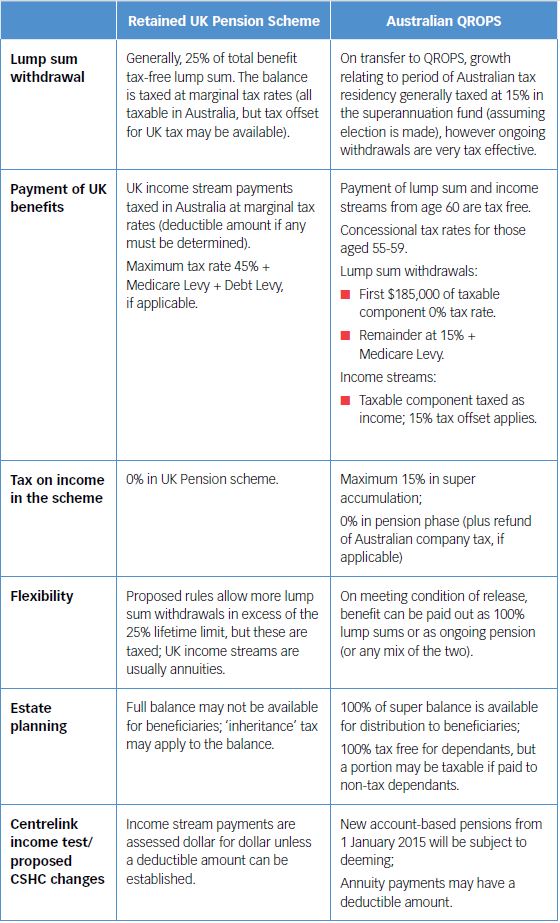

UK Pension Scheme versus an Australian QROPS

What should I do next?

We would emphasise that there are relative merits of both options (i.e., retaining capital in the UK, or transferring to a QROPS in Australia).

Nexia can help compare the options based on your particular circumstances and objectives to help you make an informed decision about the best way forward.

Before making any decision to transfer your pension benefits, contact a Nexia advisor today for more information.

Sylvia Liang, Financial Services Director - Sydney Office