Planning and due diligence key to acquisitions

Acquirers of businesses usually need to be cautious, but they should pursue a transaction knowing that they have done their utmost to arrive at the right decision and conscious of what they want to achieve.

Generally, the main reason for any acquisition is to either increase market share, own a greater share of the supply chain, acquire a new product or service, or expand into new regions.

Knowing what the objective is, it is important to ensure that you fully understand the target company and whether or not it will meet these objectives.

Key points to consider include:

- Has appropriate due diligence been undertaken?

- Do you understand the risks and opportunities in the target company?

- Is there a plan in place to integrate the business to realise the value?

- Is the right funding in place for the acquisition and any working capital requirements?

Whenever our clients indicate that they are considering acquisitions as part of their growth strategy, we comprehensively discuss the issues around their merger, takeover or acquisition.

Nexia has the professional strength that can identify and guide clients through the various stages of acquisition from determining the strategy, identifying and approaching target companies, valuing and structuring the offer, conducting due diligence, negotiating the acquisition and through to developing the integration plan.

Nexia also prepares and circulates a review of mid-market activity so that our clients and potential business owners can understand the industries attracting most attention, the interest of foreign investment and an EBITDA multiple analysis of private company pricing relative to ASX indices.

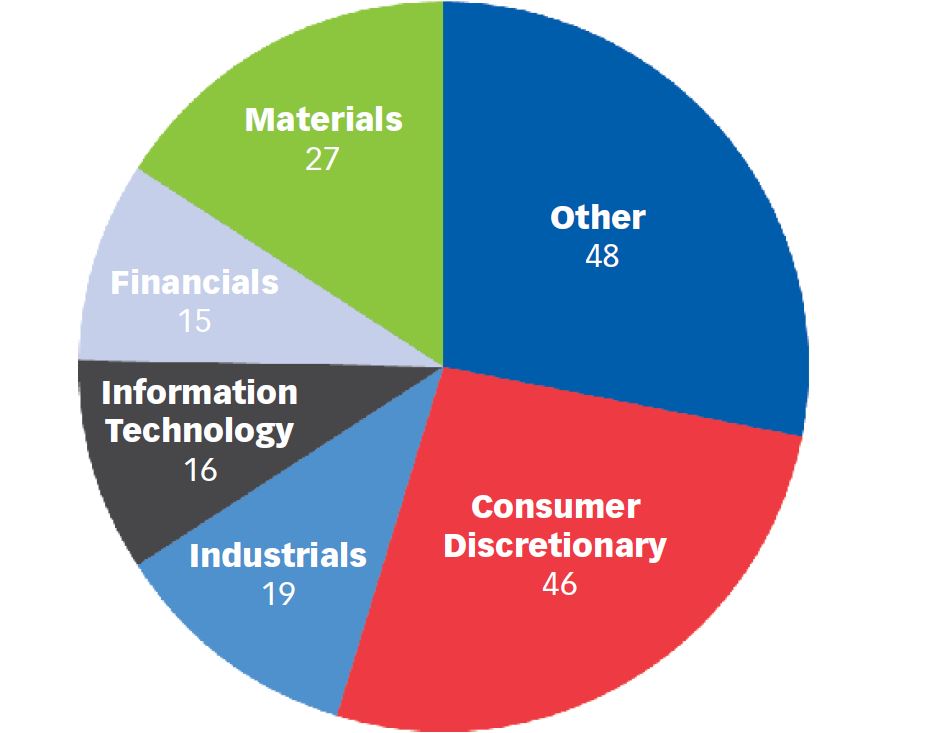

For the second quarter in this 2015 financial year, Nexia has identified that three sectors – consumer discretionary, materials (mainly mining related industries) and industrials – accounted for more than 50 per cent of transactions in that period.

Materials has almost doubled its transactions for the quarter (up 93 per cent on the previous quarter), which is the most activity for any sector since it recorded 29 transactions in the second quarter of FY2014.

The information technology sector, which had previously overtaken materials in relation to the number of transactions, dropped down to fourth place after having produced 26 transactions a quarter on average every quarter since the first period of FY2013.

The most active industry was metals and mining with 23 transactions for the quarter, followed by consumer services. However, commercial and professional services contained within the industrials sector has had the largest decrease in activity, being down 64 per cent on the previous quarter with eight transactions.

Overseas operators continue to show interest in Australian acquisitions with 21 per cent of transactions for this period, equal to the average for previous quarters.

While US companies continue to be the largest acquirers of Australian businesses (7 per cent of all acquisitions in this quarter), United Kingdom acquirers, historically the second most active, have been less interested over the past two years with only two transactions in the quarter and three for the financial year to date.

Singaporean companies remain the second most active acquirers in Australia, representing 3 per cent of total transactions for the period.

International acquirers were most active in industrials (mainly capital goods) and consumer discretionary at 24 per cent of foreign acquisitions each.

Should you wish to discuss a more detailed analysis of the mid-market review or for information about mergers and acquisitions, please contact your Nexia advisor.

Brent Goldman, Partner - Sydney Office